- Joined

- Dec 11, 1997

- Messages

- 9,077,501

Looking nice and peachy in Germany Blow for Merkel as German talks collapse

Meh. It's easy for banks to move their main legal operations base. It's as simple as changing some legal documentation. Massive infrastructure change doesn't need to happen overnight (though it is) - but in terms of passporting rules etc, it's relatively easy for them to ditch the UK. The infrastructure can move afterwards, if it needs to.

Which I'm currently watching them do, whilst people all about me find themselves redundant as stuff/people in HK, Singapore, US and Paris/Frankfurt gets massively ramped up instead.

Ditto.I really don't think you understand as much about the situation as you think you do.

Ditto.

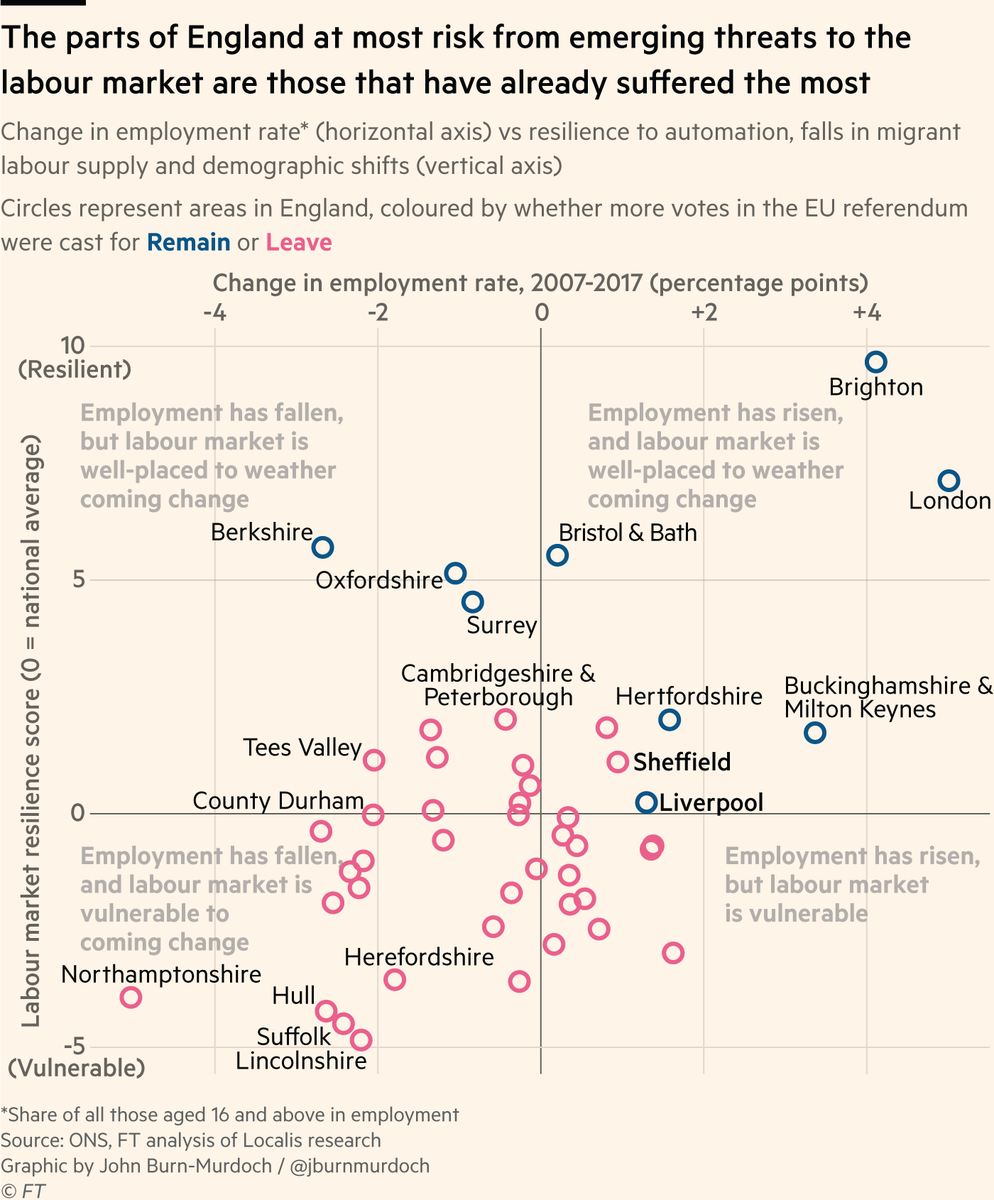

Every one of the left-behind areas at risk of going further backwards voted Leave

Every area that voted Remain is well-placed to cope with future shifts

Remoaners indeed

I may not agree with Bodhi on many things, but he's right in this case. What will move to the EU is the legal entity that companies are using. It's names in a registry, a few database entries somewhere. Maybe a few hundred people at the most. Workers in London are going to wear two hats, one for the UK legal entity, another for the European Union legal entity that they represent. If they think that businesses are going to move entire departments to EU countries, they are massively mistaken.

When I worked at RBS, even though my employer was RBS Securities Incorporated (A US company), there was no differentiation between RBS UK, RBS US and the leftover bits of ABN Amro that RBS had bought. The systems were the same, and the legal entity was a field that wasn't even displayed unless you manually added it.

At Deutsche Bank, my payslip was some New Jersey incorporated legal entity. The reality was that I worked for the DB New York division, and the name of my payslip didn't really matter that much; I supported the platforms used across the world, and could log onto a server in Asia or Europe as easily as a NY server.

I have friends at other banks who recently sold their African, Asian or South American businesses. Their technology was entirely based in London or NY, so as soon as the ink was dry, they started a new business in that region. Why not? They have the infrastructure and the expertise sitting offshore... A few local fixers and you're away.

Now, the EU have said that doing the above wont be acceptable.... but just how are they going to stop it? The Swiss banks have internal firewalls that prevent non Swiss divisions from accessing Swiss servers. It's a total mess from a technology perspective. I can't see that working for anyone else.

And yet I'm working at a bank watching them do exactly that to their staff.If they think that businesses are going to move entire departments to EU countries, they are massively mistaken.

It's pretty obvious - the better off (and better educated) are going to not get hurt by Brexit, despite having largely voted remain, whereas the poor and/or thick - the Brexiteers - are the ones who are going to (continue to) get bummed (though harder, from now on).I'm curious what that is meant to actually mean.

I may not agree with Bodhi on many things, but he's right in this case. What will move to the EU is the legal entity that companies are using. It's names in a registry, a few database entries somewhere. Maybe a few hundred people at the most. Workers in London are going to wear two hats, one for the UK legal entity, another for the European Union legal entity that they represent. If they think that businesses are going to move entire departments to EU countries, they are massively mistaken.

When I worked at RBS, even though my employer was RBS Securities Incorporated (A US company), there was no differentiation between RBS UK, RBS US and the leftover bits of ABN Amro that RBS had bought. The systems were the same, and the legal entity was a field that wasn't even displayed unless you manually added it.

At Deutsche Bank, my payslip was some New Jersey incorporated legal entity. The reality was that I worked for the DB New York division, and the name of my payslip didn't really matter that much; I supported the platforms used across the world, and could log onto a server in Asia or Europe as easily as a NY server.

I have friends at other banks who recently sold their African, Asian or South American businesses. Their technology was entirely based in London or NY, so as soon as the ink was dry, they started a new business in that region. Why not? They have the infrastructure and the expertise sitting offshore... A few local fixers and you're away.

Now, the EU have said that doing the above wont be acceptable.... but just how are they going to stop it? The Swiss banks have internal firewalls that prevent non Swiss divisions from accessing Swiss servers. It's a total mess from a technology perspective. I can't see that working for anyone else.

But its hardly going to collapse into a big hole in the ground, is it?

While I am sure some of the people that need constant reassurance would like that to happen, for whatever reason, its just not going to happen.

It was all set in motion from the moment May announced that they didn't want the ECJ to have any legal power over the UK. Everything else is a logical consequence of that.My issue with what's going on is that its all so unnecessary. UKGov doesn't have to pursue a hard Brexit, doesn't have to leave the customs union, and yet they seem to be determinedly heading towards both those things on purely ideological grounds, despite everyone, including the banks, the CBI and their own civil servants telling them its a dumb idea that's going to cause a world of pain for little or no benefit. And while no, The City isn't going to collapse into a big hole in the ground, over time, as investment decisions are being made, and its a choice between 400m people in the EU or 65m in the UK, the money will go to the EU. It just will. And in order to service the next big growth opportunity in the EU, which was cross-border financial services beyond banking (e.g. insurance), British companies will now have to do that from within the EU, and the revenues and taxes from that will stay in the EU.

But not meaningless for EU passporting system for banks and financial services. Even if your Head Office is domiciled in the EU, your UK Financial service co won't be part of the passporting unless we come to some agreement so it will cost more.

British banks 'will lose access to the EU' after Brexit

We'll be out of Europe. Why the fuck should we retain it? It's worth a shedload of cash - that they'll now spend on a European city instead.lol

MY BALL I'M, TAKING IT HOME

We'll be out of Europe.

Don't you know?!?! when we leave the EU the ropes are being cut and we are floating off into the Atlantic!

The experts said so!