You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Question Is minimising your tax bill "morally wrong"?

- Thread starter DaGaffer

- Start date

opticle

Part of the furniture

- Joined

- Sep 14, 2011

- Messages

- 1,201

TLDR

I think the immoral argument against Jimmy Carr from David Cameron is ridiculous considering he refuses to comment on other celebrities that endorse the Conservative party and do just as much wrong.

Plus, it obviously fucking highlights that they're shit at running the tax system and closing these loopholes, credit to people for finding them and having the balls to use them. As one politician said - government shouldn't comment on morality, just legality.

It's legal, fair play.

I think the immoral argument against Jimmy Carr from David Cameron is ridiculous considering he refuses to comment on other celebrities that endorse the Conservative party and do just as much wrong.

Plus, it obviously fucking highlights that they're shit at running the tax system and closing these loopholes, credit to people for finding them and having the balls to use them. As one politician said - government shouldn't comment on morality, just legality.

It's legal, fair play.

Wazzerphuk

FH is my second home

- Joined

- Dec 22, 2003

- Messages

- 12,054

Turamber

FH is my second home

- Joined

- May 15, 2004

- Messages

- 3,559

Hearing a politician use phrases like "morally repugnant" makes me feel rather ill. Cameron's failure to criticise Conservative supporter Gary Barlow makes him look exceedingly foolish as well, as Barlow uses a very similar scheme himself.

Tax is a fact of life and a necessary evil. There are ways to minimise the amounts we pay and as long as they are legal I have no great issue with them, probably in part as I am an Accountant and make my living that way.

I find the particular scheme in question to be rather dodgy, though, as it works on the basis of loans from an overseas trust. At what point in time is the individual required to repay those loans? Not a scheme I would sign up for or recommend to any of my clients. It is very similar, or appears very similar, to the overseas employment benefit trust used by Glasgow Rangers... didn't work out very well for them in the end did it?

I would also mention that HM Revenue & Customs have used tax planning opportunities to shelter profits arising out of the sale of property in the past and politicians employ teams of advisors, including tax advisors.

Tax is a fact of life and a necessary evil. There are ways to minimise the amounts we pay and as long as they are legal I have no great issue with them, probably in part as I am an Accountant and make my living that way.

I find the particular scheme in question to be rather dodgy, though, as it works on the basis of loans from an overseas trust. At what point in time is the individual required to repay those loans? Not a scheme I would sign up for or recommend to any of my clients. It is very similar, or appears very similar, to the overseas employment benefit trust used by Glasgow Rangers... didn't work out very well for them in the end did it?

I would also mention that HM Revenue & Customs have used tax planning opportunities to shelter profits arising out of the sale of property in the past and politicians employ teams of advisors, including tax advisors.

Tom

I am a FH squatter

- Joined

- Dec 22, 2003

- Messages

- 17,603

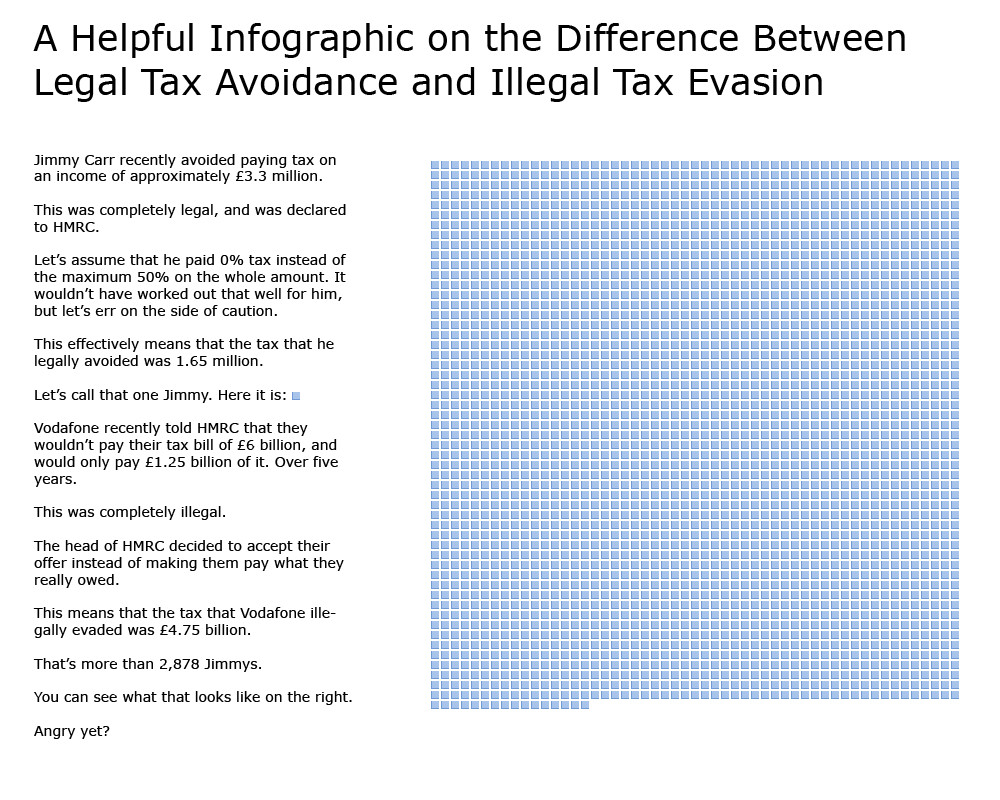

That Vodafone image says that Vodafone's deal with HMRC was "completely illegal". Which is utter bollocks, the deal was totally legal. Vodafone disputed HMRC's estimate that they owed £6bn, HMRC weren't certain of their position and didn't want to risk a huge legal bill and an epic fail, so settled the matter out of court.

milou

Part of the furniture

- Joined

- Dec 22, 2003

- Messages

- 628

Indeed. Massive assumptions being made over the Vodafone issue. Overall, tax needn't be taxing.

In other news >> http://newsthump.com/2012/06/21/jim...-using-search-term-cameron-fortune-tax-haven/

In other news >> http://newsthump.com/2012/06/21/jim...-using-search-term-cameron-fortune-tax-haven/

Killswitch

FH is my second home

- Joined

- Jan 29, 2004

- Messages

- 1,584

I think it's clear cut in terms of of big businesses. The board have a legal obligation to operate in the best interests of the shareholders. They also have a legal obligation to pay taxes according to the laws of the country in which they operate. In this situation the board *must* arrange their tax affairs in such a way that they pay the minimum possible amount of tax without breaking any laws. Morality doesn't come in to the question at all. With individuals it might be different but I'm not sure it should be. Jimmy Carr is as much of a brand or a business as IBM or Ford and has the right to arrange his affairs in the way which is most beneficial to the shareholders (him, basically) provided he remains inside the constraints of the law.

I think the issue with Jimmy is more that he's an easy person to criticize because he's a very divisive figure and he's been very critical of banks and other financial institutions. Being a satirist means walking a fine line because it requires you to have credibility. One sniff of hypocrisy or favoritism and your comedy loses its power. This is the only reason I can think of as to why he would apologise and remove himself from the tax avoidance scheme.

I think the issue with Jimmy is more that he's an easy person to criticize because he's a very divisive figure and he's been very critical of banks and other financial institutions. Being a satirist means walking a fine line because it requires you to have credibility. One sniff of hypocrisy or favoritism and your comedy loses its power. This is the only reason I can think of as to why he would apologise and remove himself from the tax avoidance scheme.

Embattle

FH is my second home

- Joined

- Dec 22, 2003

- Messages

- 14,172

TdC

Trem's hunky sex love muffin

- Joined

- Dec 20, 2003

- Messages

- 30,925

Vodafone disputed HMRC's estimate that they owed £6bn, HMRC weren't certain of their position and didn't want to risk a huge legal bill and an epic fail, so settled the matter out of court.

just in case things are odd on your island...how can there be so much guesswork and vaguery going on there? I mean, surely Voda MUST submit their figures by law, and in which tax brackets they fall, to the royal tax gougers, and for the latter it's "simply" a matter of checking the books? How can the estimate be -if Voda is really right- so wildly off? or is this the special deals with large corporations thing going on -you know, like governments tend to do- creating this exact situation?

Users who are viewing this thread

Total: 2 (members: 0, guests: 2)