You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Bitcoins

- Thread starter Tilda

- Start date

DaGaffer

Down With That Sorta Thing

- Joined

- Dec 22, 2003

- Messages

- 18,814

Well it does have a worth, actually. It costs electricity and compute power to generate a bitcoin. You can work out the fundamental value without too much trouble if you had the basic figures to hand:

efficiency of flops/watt for every year they've been in circulation

cost in flops for every tranche of bitcoins (the rate at which you can mine them slows over time to force deflation)

With that, 30 seconds in excel would give you a lower limit in terms of the price in real terms of making them. The difference between that price and what people pay is the fiat bit. I'd go so far as to say that if it drops below the fundamental price, you might as well pile in. I suspect it's pretty low, though, <$10 at a guess.

I thought the whole point of bitcoins was there was a finite supply? So the cost of production is less relevant than the cost of demand that drives the value?

Chilly

Balls of steel

- Joined

- Dec 22, 2003

- Messages

- 9,047

Indeed, but while the supply is still available, the price of a bitcoin is going to be linked to production cost. Once the currency is 100% floated, it will transition away from having any intrinsic value to being the same as any modern currency: ie a scamI thought the whole point of bitcoins was there was a finite supply? So the cost of production is less relevant than the cost of demand that drives the value?

Chilly

Balls of steel

- Joined

- Dec 22, 2003

- Messages

- 9,047

It's part of the maths of the system, if I recall. I looked into it a few years ago when it was first publicized but have forgotten most of the detail. The main point is that it's completely decentralised.Who decides how the quantity of bitcoins are made available?

I read that back and I'm not sure it's even English. Who controls the quantity of bitcoins in the market?

- Joined

- Dec 22, 2003

- Messages

- 38,439

Who decides how the quantity of bitcoins are made available?

The maths.

We give them their value.

Edit: Gah Chilly

When you download the bitcoin system you get the entire transaction log with it. The openness helps prevent fraud - if

- Joined

- Dec 22, 2003

- Messages

- 38,439

So. This was fun to find

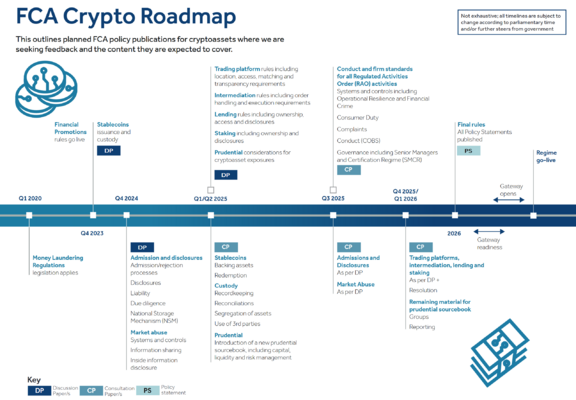

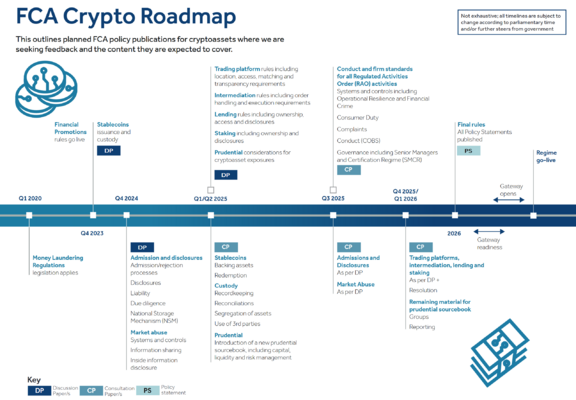

FCA roadmap for Crypto. We'll be buying / trading them through traditional investment platforms by the end of 2026 - just like traditional investments

I mean. It's a bit of a gutter for UK investors that Americans can pour, say, 10% of their investment portfolio into the growth areas and benefit from institutional investment growth right now. But hey ho.

Regardless of whether people still think it's a scam - it's still more transparent than traditional cash and hopefully by now people can see it's value (if not it's worth). And it's here to stay*.

**quantum computing notwithstanding

FCA roadmap for Crypto. We'll be buying / trading them through traditional investment platforms by the end of 2026 - just like traditional investments

I mean. It's a bit of a gutter for UK investors that Americans can pour, say, 10% of their investment portfolio into the growth areas and benefit from institutional investment growth right now. But hey ho.

Regardless of whether people still think it's a scam - it's still more transparent than traditional cash and hopefully by now people can see it's value (if not it's worth). And it's here to stay*.

**quantum computing notwithstanding

- Joined

- Dec 22, 2003

- Messages

- 38,439

You don't understand crypto. That's OK.It takes 20 minutes to send. Completely pointless in any real setting. Until they speed it up, it's just a meme, to redistribute wealth, up.

Embattle

FH is my second home

- Joined

- Dec 22, 2003

- Messages

- 14,151

You don't understand crypto. That's OK.

What part, that it takes 20 minutes or is still largely pointless and just for speculation.

At the moment, they aren't supported by any official government bodies, so the rule is quite simple: if you invest in them and lose money, it is your fault and you're not entitled to any help or support.

- Joined

- Dec 27, 2003

- Messages

- 45,540

I mean, Crypto, as a whole, is a series of memes that bleed wealth from people desperate enough to buy it. There are certain coins that are legit, that I can buy drugs with, which are nice, but it takes ages, and is frustrating. But really, they are just a thing that have a value, simply because there is a market, a self propped up nothing.You don't understand crypto. That's OK.

Overdriven

Dumpster Fire of The South

- Joined

- Jan 23, 2004

- Messages

- 12,893

I mean, Crypto, as a whole, is a series of memes that bleed wealth from people desperate enough to buy it. There are certain coins that are legit, that I can buy drugs with, which are nice, but it takes ages, and is frustrating. But really, they are just a thing that have a value, simply because there is a market, a self propped up nothing.

It's far too early to have this existential crisis conversation about perceived value.

It's worth is what it's worth because that's what people are willing to pay for it.

Perceived value > tangible value.

(cough Tesla stocks cough)

Embattle

FH is my second home

- Joined

- Dec 22, 2003

- Messages

- 14,151

It's far too early to have this existential crisis conversation about perceived value.

It's worth is what it's worth because that's what people are willing to pay for it.

Perceived value > tangible value.

(cough Tesla stocks cough)

They are little more than legal Ponzi schemes.

Overdriven

Dumpster Fire of The South

- Joined

- Jan 23, 2004

- Messages

- 12,893

They are little more than legal Ponzi schemes.

Yep.

Look at Nvidia taking a near 20pp loss when DeepSeek was announced. Their stock is highly over-valued as it is. Perceived value..

Am just grumpy because I don't have any BTC and even grumpier that I would have sold anyway.

- Joined

- Dec 22, 2003

- Messages

- 38,439

It looks like in the intervening years people didn't bother to follow what's been going on, to educate themselves about use-cases and to track how things continue to develop.

I posted the FCA's official regulatory development timeline. That should give a little pause for deeper thought.

But I guess once people made their mind up, that made them feel warm and comfy and people want to cling to those blankets...

I posted the FCA's official regulatory development timeline. That should give a little pause for deeper thought.

But I guess once people made their mind up, that made them feel warm and comfy and people want to cling to those blankets...

Users who are viewing this thread

Total: 2 (members: 0, guests: 2)